Some Of Nj Cash Buyers

Some Of Nj Cash Buyers

Blog Article

An Unbiased View of Nj Cash Buyers

Table of ContentsA Biased View of Nj Cash BuyersThe smart Trick of Nj Cash Buyers That Nobody is DiscussingA Biased View of Nj Cash BuyersThe Basic Principles Of Nj Cash Buyers

The majority of states approve customers a particular level of protection from lenders concerning their home. "That means, regardless of the value of the house, financial institutions can not force its sale to satisfy their claims," says Semrad.If your home, for example, is worth $500,000 and the home's mortgage is $400,000, your homestead exemption can protect against the forced sale of your home in order to pay creditors the $100,000 of equity in your house, as long as your state's homestead exemption is at least $100,000. If your state's exemption is much less than $100,000, a bankruptcy trustee can still compel the sale of your home to pay lenders with the home's equity over of the exemption. You can still enter into repossession through a tax lien. If you stop working to pay your home, state, or federal taxes, you might lose your home through a tax lien. Buying a house is much simpler with money. You don't have to wait for an examination, evaluation, or underwriting.

(https://www.localshq.com/directory/listingdisplay.aspx?lid=88033)I recognize that several sellers are more most likely to accept a deal of cash, yet the vendor will obtain the money regardless of whether it is financed or all-cash.

Some Known Questions About Nj Cash Buyers.

Today, concerning 30% of United States property buyers pay cash money for their residential properties. There might be some excellent factors not to pay money.

You might have credentials for an excellent home loan. According to a current research study by Cash publication, Generation X and millennials are thought about to be populations with one of the most possible for development as customers. Taking on a bit of financial debt, especially for tax obligation functions terrific terms could be a far better choice for your finances on the whole.

Perhaps buying the securities market, mutual funds or an individual business could be a better alternative for you in the lengthy run. By acquiring a property with cash money, you run the risk of diminishing your reserve funds, leaving you susceptible to unexpected maintenance costs. Possessing a property requires continuous expenses, and without a mortgage cushion, unanticipated repair work or restorations could stress your financial resources and prevent your capability to keep the residential or commercial property's condition.

The smart Trick of Nj Cash Buyers That Nobody is Discussing

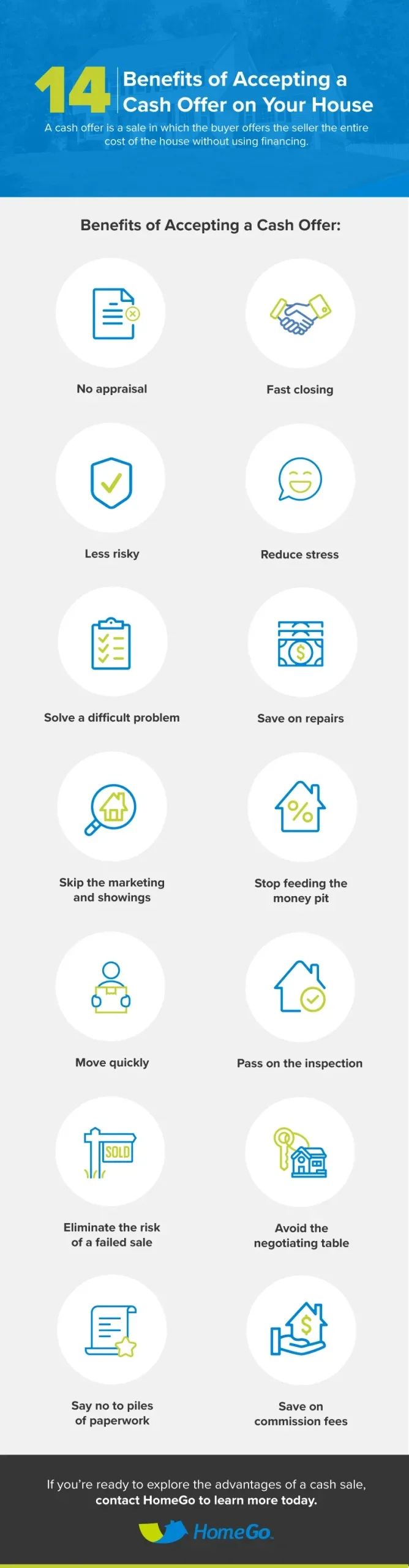

Home costs rise and drop with the economic climate so unless you're intending on hanging onto the house for 10 to 30 years, you could be much better off spending that cash money in other places. Buying a residential or commercial property with cash can expedite the buying process substantially. Without the requirement for a home mortgage authorization and connected paperwork, the transaction can shut quicker, providing an affordable side in affordable realty markets where vendors might like cash customers.

This can lead to substantial cost savings over the long-term, as you will not be paying interest on the loan quantity. Money customers typically have more powerful arrangement power when handling vendors. A cash offer is more attractive to vendors given that it minimizes the risk of an offer failing as a result of mortgage-related problems.

Bear in mind, there is no one-size-fits-all option; it's vital to tailor your decision based upon your private circumstances and lasting aspirations. All set to begin checking out homes? Provide me a phone call anytime.

Whether you're selling off assets for an investment property or are diligently conserving to buy your dream residence, buying a home in all money can dramatically raise your acquiring power. It's a tactical action that enhances your setting as a buyer and improves your adaptability in the property market. However, it can place you in a monetarily susceptible place (sell my house fast new jersey).

The 3-Minute Rule for Nj Cash Buyers

Saving on rate of interest is among the most usual factors to buy a home in cash money. Throughout a 30-year mortgage, you might pay tens of thousands or also thousands of countless bucks in complete rate of interest. Additionally, your buying power raises without financing contingencies, you can explore a broader selection of homes.

Realty is one investment that often tends to outpace inflation with time. Unlike supplies and bonds, it's thought about less dangerous and can provide brief- and lasting wealth gain. One caution to note is that throughout details financial markets, realty can produce much less ROI than other financial investment enters the brief term.

The biggest risk of paying cash money for a house is that it can make your finances unstable. Linking up your fluid possessions in a home can decrease financial flexibility and make it extra difficult to cover unforeseen costs. Furthermore, locking up your cash indicates losing out on high-earning financial investment chances that could yield higher returns somewhere else.

Report this page